The Of Clark Wealth Partners

Things about Clark Wealth Partners

Table of ContentsAbout Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.The Ultimate Guide To Clark Wealth PartnersExcitement About Clark Wealth PartnersFacts About Clark Wealth Partners UncoveredThe Clark Wealth Partners PDFsThe Clark Wealth Partners Ideas

These are experts who offer investment advice and are signed up with the SEC or their state's protections regulatory authority. Financial consultants can also specialize, such as in student loans, elderly requirements, taxes, insurance policy and various other aspects of your finances.But not constantly. Fiduciaries are legally called for to act in their customer's best interests and to maintain their money and residential property separate from various other possessions they handle. Only financial experts whose designation calls for a fiduciary dutylike licensed financial organizers, for instancecan state the very same. This difference also indicates that fiduciary and financial consultant charge structures vary also.

Not known Details About Clark Wealth Partners

If they are fee-only, they're most likely to be a fiduciary. If they're commission-only or fee-based (suggesting they're paid via a combination of charges and payments), they might not be. Numerous credentials and designations call for a fiduciary obligation. You can check to see if the expert is signed up with the SEC.

Choosing a fiduciary will ensure you aren't steered toward certain financial investments because of the compensation they use - civilian retirement planning. With great deals of money on the line, you may want a financial professional who is legally bound to use those funds thoroughly and only in your benefits. Non-fiduciaries might advise investment products that are best for their pocketbooks and not your investing goals

All about Clark Wealth Partners

Check out much more now on just how to keep your life and financial savings in balance. Boost in financial savings the typical household saw that dealt with a financial expert for 15 years or more contrasted to a similar household without a monetary advisor. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "Extra on the Worth of Financial Advisors," CIRANO Job News 2020rp-04, CIRANO.

Financial guidance can be beneficial at transforming factors in your life. When you meet with an adviser for the very first time, function out what you desire to get from the guidance.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Once you've accepted proceed, your economic consultant will certainly prepare an economic strategy for you. This is offered to you at one more meeting in a paper called a Declaration of Suggestions (SOA). Ask the consultant to clarify anything you do not comprehend. You must always feel comfy with your consultant and their recommendations.

Firmly insist that you are notified of all transactions, which you get all correspondence pertaining to the account. Your advisor may recommend a handled discretionary account (MDA) as a means of handling your investments. This entails signing an agreement (MDA agreement) so they can purchase or market financial investments without having to contact you.

Rumored Buzz on Clark Wealth Partners

Prior to you invest in an MDA, contrast the advantages to the costs and dangers. To protect your money: Don't give your advisor power of lawyer. Never sign an empty record. Put a time frame on any kind of authority you give to deal investments in your place. Urge all correspondence concerning your investments are sent out to you, not just your advisor.

If you're moving to a brand-new advisor, you'll need to arrange to transfer your financial documents to them. If you require help, ask your adviser to explain the process.

To load their shoes, the country will need even more than 100,000 brand-new monetary advisors to get in the market.

4 Simple Techniques For Clark Wealth Partners

Helping individuals attain their economic objectives is an economic advisor's main feature. However they are additionally a local business proprietor, and a portion of their time is devoted to handling their branch office. As the leader of their method, Edward Jones monetary consultants need the leadership abilities to employ and handle personnel, in addition page to business acumen to develop and perform an organization technique.

Investing is not a "collection it and forget it" activity.

Financial consultants must set up time each week to fulfill brand-new individuals and capture up with the people in their sphere. Edward Jones financial experts are fortunate the home office does the heavy training for them.

Clark Wealth Partners - An Overview

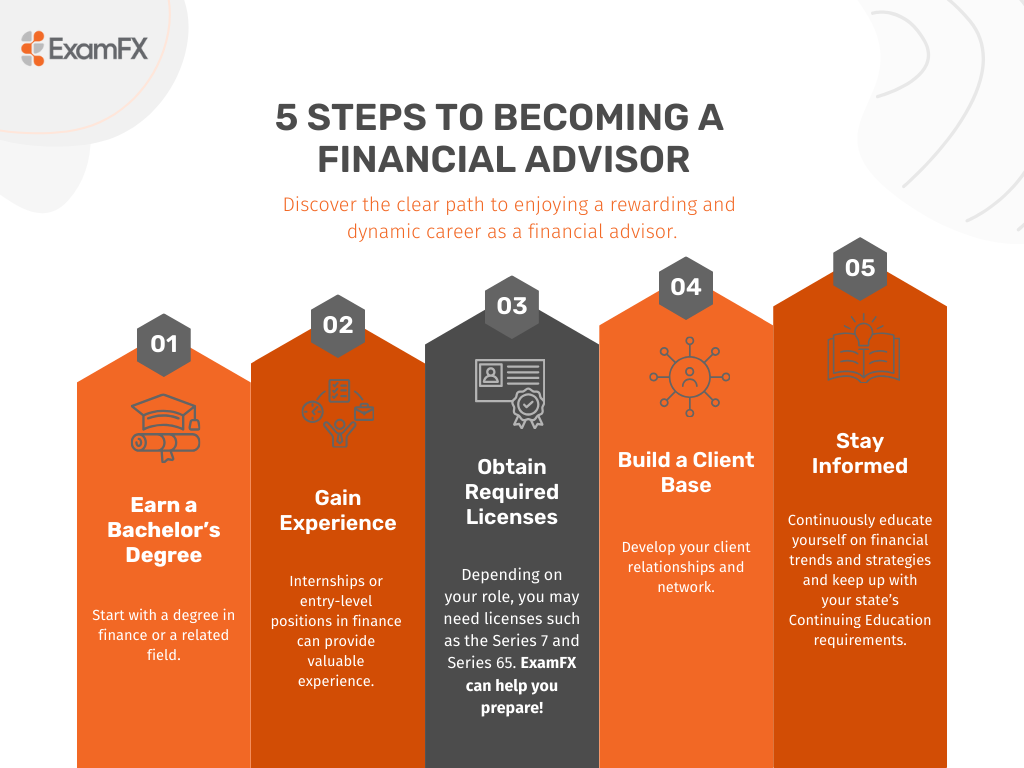

Proceeding education and learning is a necessary component of keeping a monetary advisor permit (financial advisors illinois). Edward Jones financial consultants are motivated to go after extra training to widen their knowledge and abilities. Dedication to education protected Edward Jones the No. 17 area on the 2024 Training peak Awards checklist by Training magazine. It's additionally a good concept for financial consultants to attend sector meetings.